As cars become increasingly connected to smartphones, official manufacturer apps have turned into a central tool in the daily lives of drivers. Through these apps, owners expect to monitor their vehicles remotely, receive up-to-date status information and manage services and maintenance quickly and easily. In reality, however, expectations are not always met, as shown by the latest study conducted by J.D. Power in the United States.

Alfa Romeo ranks last in J.D. Power’s U.S. In-Car App satisfaction study

The survey, carried out between September and October and involving more than 2,100 owners of internal combustion engine vehicles, analyzed the user experience of official brand apps across the automotive industry. Participants were asked to rate reliability, ease of use, response speed and the usefulness of available features. The results show that around 80 percent of American drivers regularly use the app connected to their car. This figure is slightly higher than last year, confirming that these digital tools are now widely adopted.

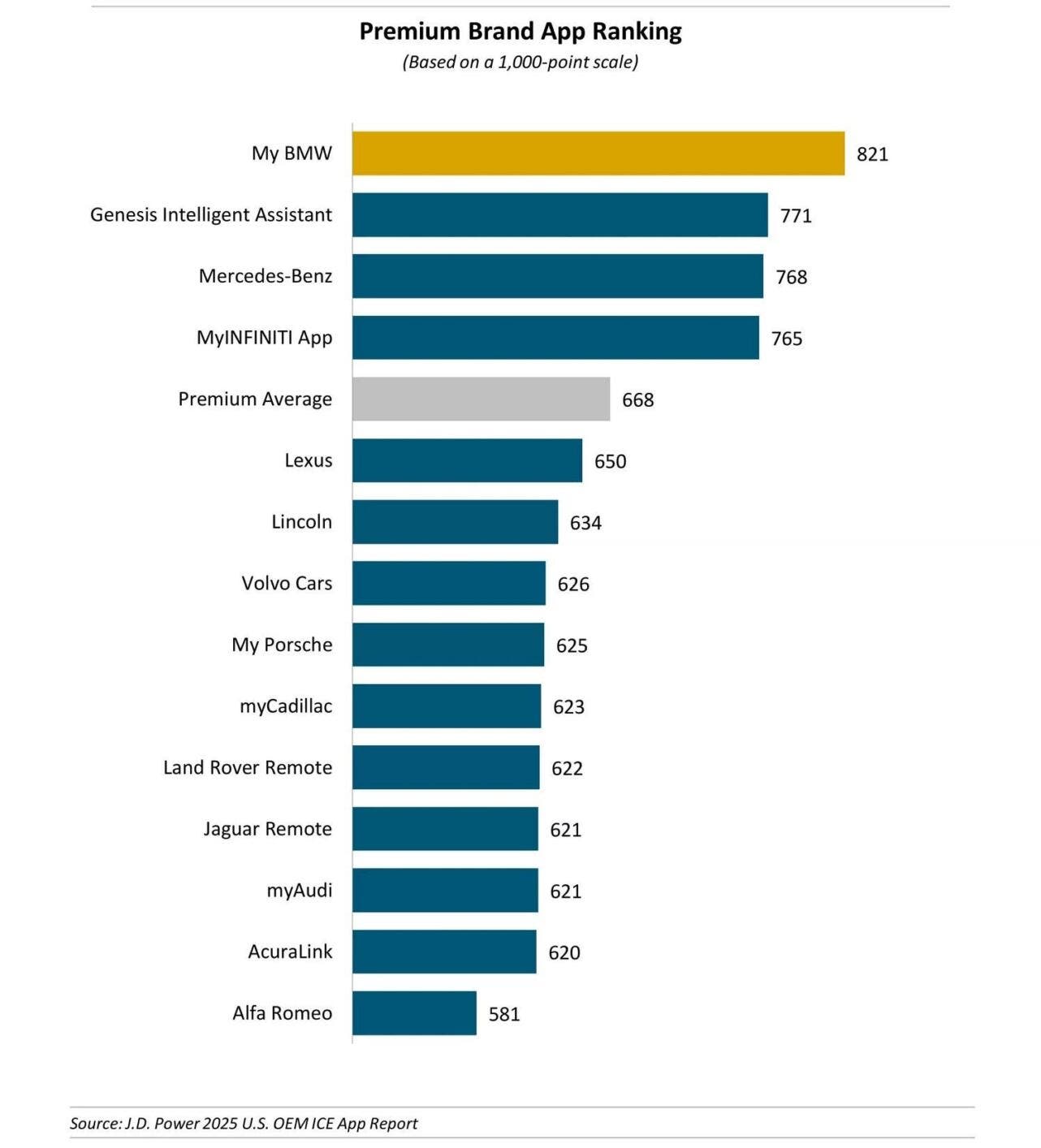

However, the J.D. Power ranking highlights significant differences among manufacturers. In the segments analyzed, Mazda and Alfa Romeo emerge as the least satisfying brands, respectively among mass-market and premium automakers. Focusing on the premium segment, the gap is particularly clear. BMW leads the ranking with a very high level of customer satisfaction, followed by Genesis and Mercedes-Benz. At the bottom of the list, and by a wide margin, sits Alfa Romeo, which finishes last with a score well below its main competitors.

A closer look at the reasons behind customer dissatisfaction reveals recurring issues. Many users abandon the app due to connectivity problems, identified as the most common complaint. Others point to unintuitive interfaces, slow response times and unreliable remote start functions. In addition, several users report outdated data, missing features or difficulties when multiple users try to access the same app, an increasingly important factor for families.

This result represents a warning sign for Alfa Romeo, especially as the brand aims to strengthen its global premium positioning. In highly competitive and digitally advanced markets such as the United States, software experience has become an integral part of a car’s perceived value. In the coming years, with the arrival of the new generations of the Giulia and Stelvio, the brand will need to close this gap by improving not only performance and build quality, but also the digital ecosystem that supports the vehicle in everyday use.