Tesla has finally broken its two-quarter revenue slump, reporting a solid 12% jump to $28.1 billion in the third quarter, easily cruising past Wall Street’s $26.37 billion consensus. Cue the celebratory air horn, right? Not so fast. The return to top-line growth came with the bitter aftertaste of a profit squeeze. Net income tanked by 37% to $1.37 billion, largely thanks to those persistent EV price cuts and a whopping 50% surge in operating expenses. Apparently, building a sustainable car company is expensive, but building a futuristic AI empire, including robotaxis and literal humanoid robots, is truly bank-breaking.

The quarter’s boost was partly artificial, driven by a pre-expiration rush of US federal EV tax credits, a short-term sugar high that masked deeper cracks. The most glaring? Europe, where Tesla is taking a beating. Stagnant demand, fierce competition from the likes of BYD and Volkswagen, and the increasingly toxic drag of Elon Musk’s brand of online politicking are making the continent a tough sell.

The CEO mostly ignored the messy details of car sales and profitability. Instead, he treated investors to a dazzling slideshow of the future, where millions of existing Teslas can suddenly become cash-generating “robotaxis” with a simple software flip. This autonomous ride-hailing service is, of course, due in Austin any day now and in 8 to 10 US cities by 2025, initially with a human chaperone.

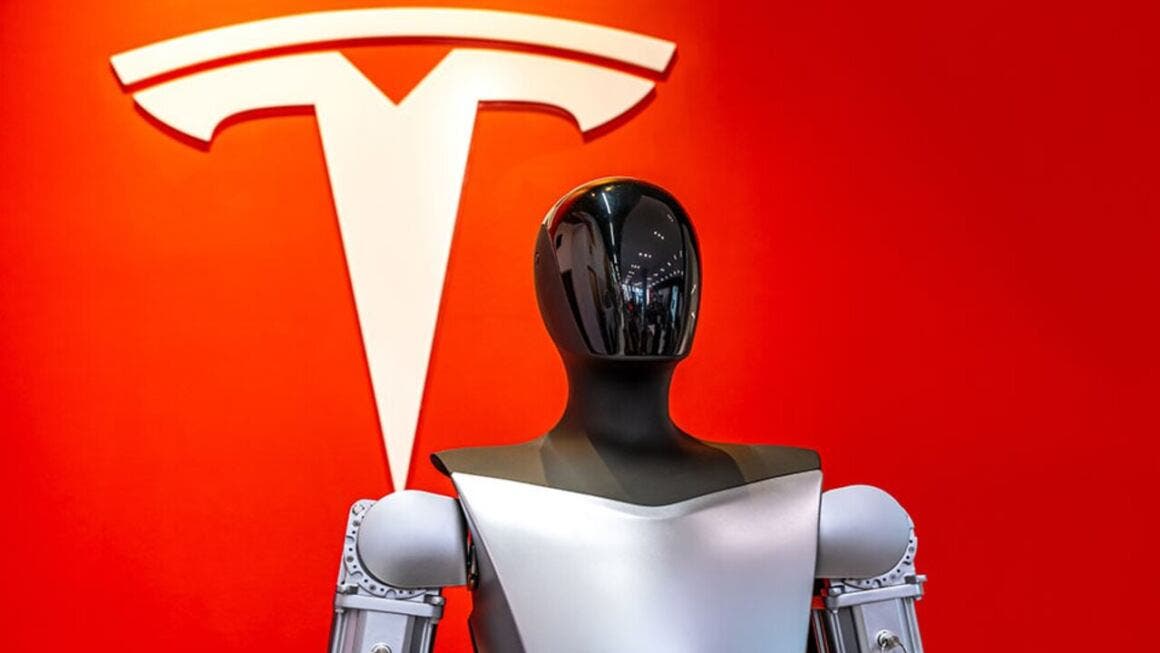

The real star of the show, however, was Optimus. Musk declared the humanoid robot to be “the biggest product of all time”, casually adding that it might one day moonlight as a surgeon.

On the hardware front, Musk unveiled new details on the internal AI5 chip, set to replace previous hardware in both autonomous driving systems and the robot army. This cutting-edge silicon will be co-produced by Samsung and TSMC, with Musk proudly aiming for an “excess of production” to power Tesla’s data centers. He even claimed the AI5 chip could offer a 10x performance-per-price edge over competitors, while simultaneously confirming Tesla still needs to heavily rely on 81,000 units worth of NVIDIA GPUs for model training.