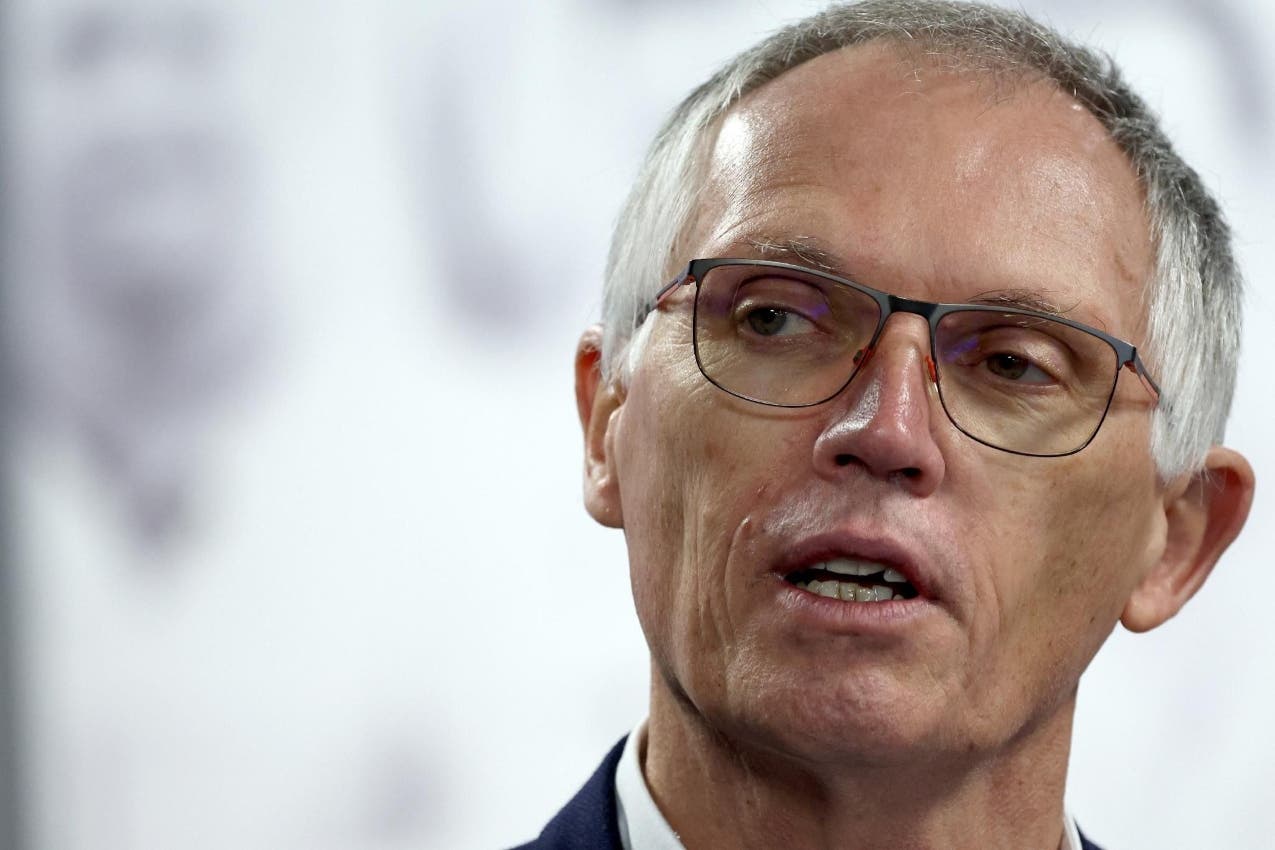

Carlos Tavares is looking at the future of the European automotive industry with deep concern. According to the former Stellantis CEO, the political decisions taken by the European Union in recent years have moved in the wrong direction. As a result, they now risk producing severe consequences for the entire sector. Tavares believes that within five years Chinese manufacturers could capture 10 percent of the European market. Such a scenario would inevitably lead to the closure of up to ten production plants across the continent.

Tavares sounds alarm as Chinese brands target Europe

“When protests break out, governments will invite the Chinese to buy the plants for a symbolic value,” Tavares said bluntly during a conference in Santa Maria da Feira. In his view, Europe’s core mistake was to impose a single technological path on the industry. Instead, policymakers should have set environmental targets and left automakers free to decide how to reach them. According to Tavares, the lack of technological neutrality and real competition between solutions opened the door wide to Chinese groups. These companies have worked on electric vehicles for more than twenty years and found themselves fully prepared at the most chaotic moment for the European market.

Tavares also supported his warning with figures. Around 15 million cars are sold every year in the European Union. A 10 percent share would therefore equal more than 1.5 million vehicles produced by Chinese brands. “That is the equivalent of ten European factories losing their workload,” he explained. “And when they lose work, protests will begin. Then an investor from Beijing will arrive, offer a few euros and the promise to protect jobs. At that point, governments will have no choice but to accept.”

According to the former head of Stellantis, now replaced by Antonio Filosa, the issue goes beyond industrial strategy. It also represents a serious social problem. The loss of production plants would directly affect local communities. Tensions, protests, and instability would inevitably follow. In such a climate, the arrival of Chinese capital could appear as a forced solution to safeguard employment, even at the cost of handing over strategic assets.

The picture outlined by Tavares therefore describes a Europe that risks paying a very high price for its energy transition choices. These decisions could reshape the balance of power across the entire automotive industry in the coming years.