The day that was supposed to celebrate Ferrari’s electric future turned into a heavy slip on the stock market. Immediately after the presentation of the first details of its first fully electric car, the so-called Ferrari Elettrica, shares of the Maranello brand suffered a historic crash, marking the worst session since 2016.

Ferrari stock suffers worst day since 2016 after electric supercar and financial projections

The stock lost over 15% in Piazza Affari, with a similar decline also on the New York listing. Despite attention being focused on the unprecedented zero-emissions model, the negative reaction from investors was not so much caused by the car’s presentation as by financial forecasts deemed too cautious.

During Capital Markets Day 2025, the Prancing Horse estimated net revenues for the current year of at least €7.1 billion, with a target of approximately €9 billion by 2030 and a minimum EBITDA of €3.6 billion in the same period. Solid numbers but below analysts’ expectations, who anticipated more ambitious growth prospects. As highlighted by CNBC and Citi Research, management’s message was interpreted as a signal of caution, triggering a strong wave of selling.

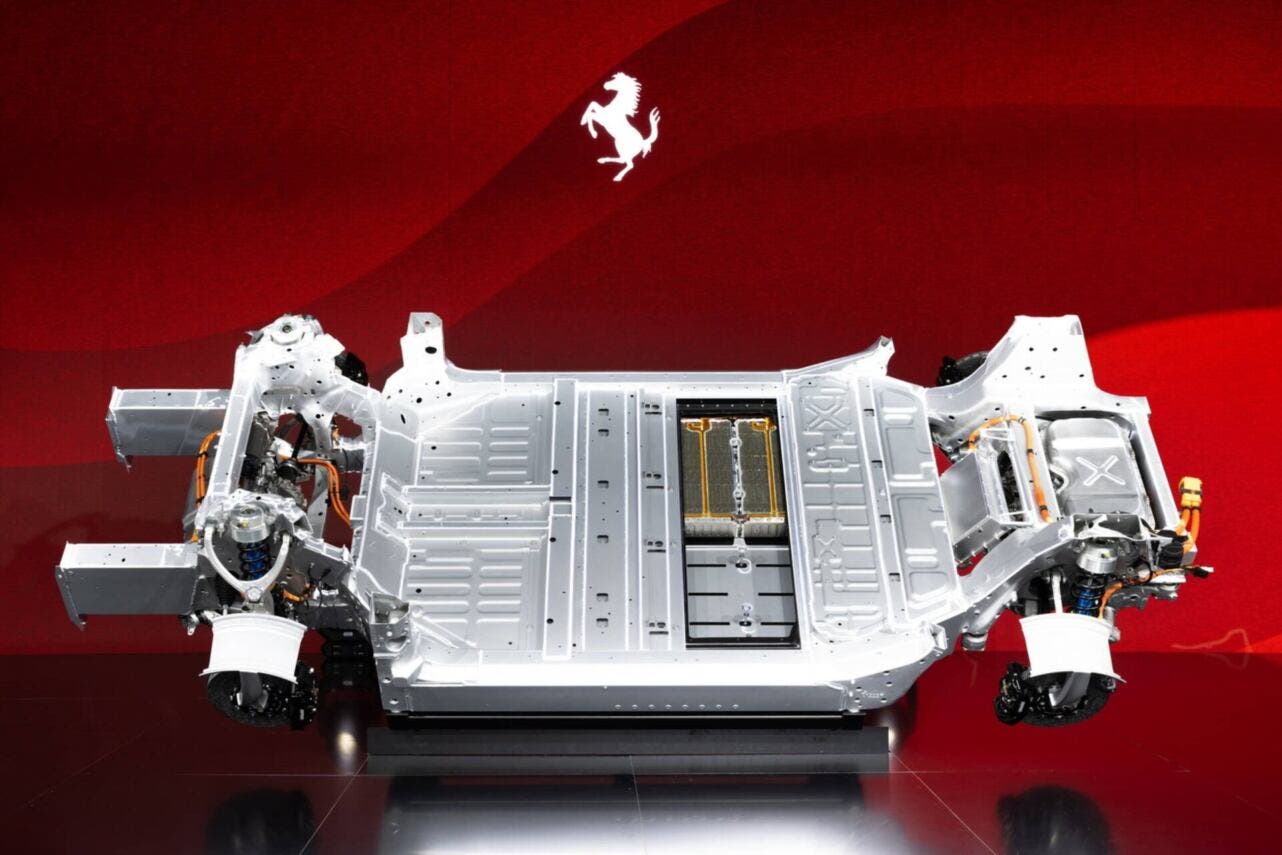

On the technical front, the Ferrari Elettrica promises authentic supercar performance: over 1,000 horsepower, range exceeding 530 km, 0-60 mph acceleration in 2.5 seconds and top speed of 310 km/h. The model will be powered by a 122 kWh battery with record energy density, 195 Wh/kg at pack level and 305 Wh/kg at cell level, and an 800-volt electrical architecture compatible with fast charging up to 350 kW. A technologically revolutionary debut, therefore, but accompanied by a prudent financial message that cooled market enthusiasm.