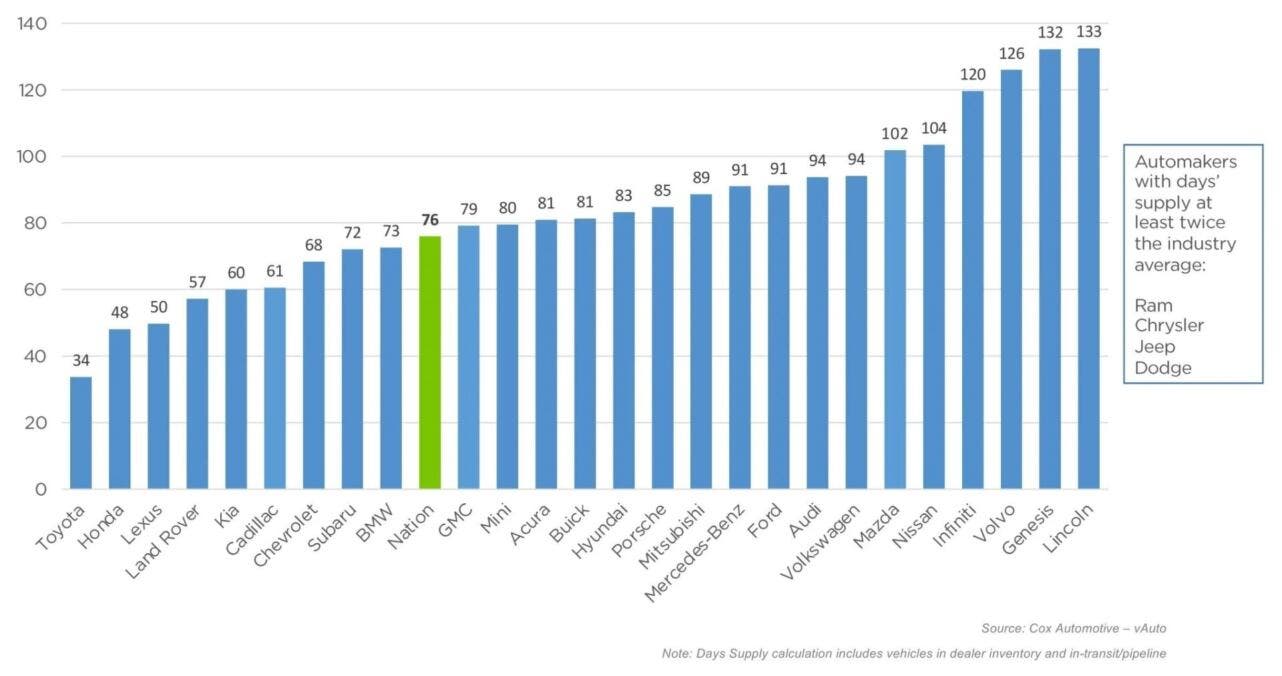

The quantity of new cars at dealerships reveals much, from their appeal to potential manufacturing dilemmas. Particularly intriguing is the insight into a brand’s demand, and it seems Dodge vehicles are increasingly found in abundance at dealerships. Cox Automotive‘s research highlights that nearly all of Stellantis’ American brands boast an inventory surpassing double the national average for new cars, pegged at 76 days. This indicates that Chrysler, Dodge, Jeep, and Ram possess inventories sufficient for about 152 days or roughly half a year.

Dodge and other American brands in Stellantis have almost half a year’s inventory

This is significant, especially considering Dodge led in inventory levels among all analyzed brands, despite discontinuing the Charger and Challenger production last December. Currently, only the Hornet and Durango are in production under Dodge, with the electric Charger Daytona expected to commence production later in the year. This might suggest Dodge’s strategic planning to keep the phased-out Charger and Challenger models available until their successors are introduced.

Beyond Dodge, the start of March saw 2.74 million new unsold vehicles, marking an increase of 942,000 units from the previous year and 130,000 units from the prior month.

While Stellantis reports substantial inventories, Toyota faces a contrasting scenario with just a 34-day supply of new vehicles. The Grand Highlander, Toyota’s latest three-row crossover, is particularly scarce, reflecting its popularity among consumers.

Toyota is followed by Honda, Lexus, Land Rover, and Kia, all managing inventories of 60 days or less. Despite the demand for foreign brands, Cadillac and Chevrolet also report constrained inventories, notably the Trax, which has seen remarkable success, partly due to its competitive starting price of $20,400. Similarly, the Ford Maverick is experiencing limited availability, with its price now starting at $23,815.

Conversely, Cox Automotive notes higher inventories for models like the Ram 1500 and Ford Explorer, the latter possibly feeling the impact of an upcoming facelift expected in dealerships in the second quarter. Another key finding from the study is the average listing price for new vehicles, now at $47,285, slightly above the previous month’s average sale price of $47,244.