Elon Musk, Tesla’s CEO, has long promoted the company’s robotaxi concept as the foundation for turning Tesla into the most valuable company in the world. His vision includes fleets of fully autonomous electric vehicles that not only provide ride-sharing services but also allow individual owners to generate income by renting out their cars when not in use.

This ambitious idea was amplified during the dramatic unveiling of the Cybercab last October and backed by supporters like Cathie Wood of Ark Invest, who has suggested robotaxis could boost Tesla’s valuation to $5 trillion. Progress, however, has been slower than anticipated.

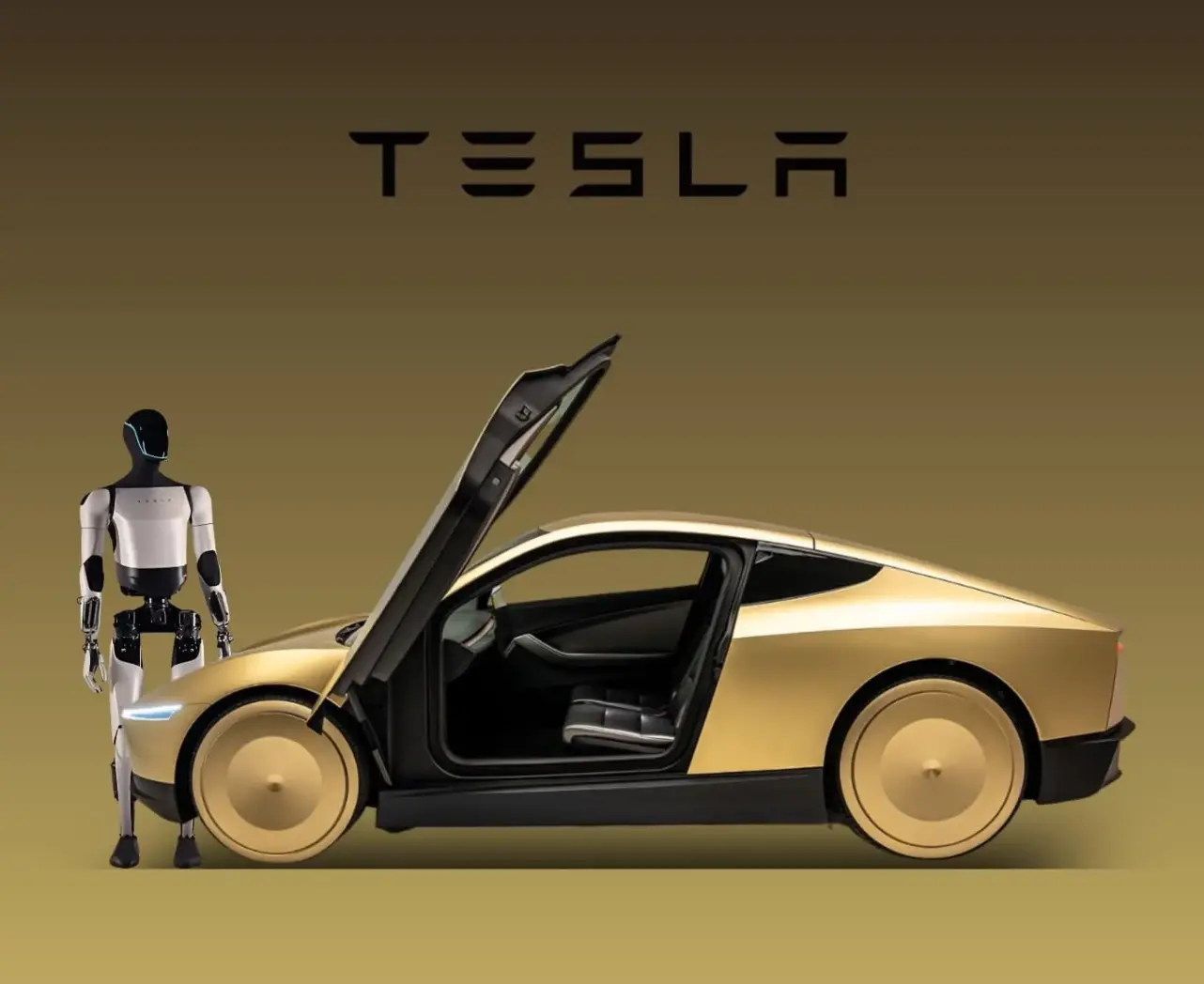

The pilot fleet launched in Austin grew modestly from around a dozen cars to 30 by late summer, but Musk has since grown quieter about the project. Instead, he has shifted focus to Optimus, Tesla’s humanoid robot, declaring on X that 80% of Tesla’s future value will come from it. Such comments suggest that robotaxis may no longer be the company’s top priority.

Investors are well aware that Musk’s bold forecasts often mix enthusiasm with strategic showmanship. His announcements frequently serve to redirect attention from Tesla’s immediate challenges to futuristic promises. This dynamic is evident in the stock’s performance: despite Tesla’s US EV market share dropping to 38%, its lowest since 2017, shares have rebounded thanks to headlines about robotics, new permits to test robotaxis in Nevada, and Musk’s $1 billion stock purchase. Operationally, Tesla has received approval to launch robotaxi services in the Bay Area, though rides still require a safety driver.

Musk had predicted half of the US population would have access to Tesla ride-hailing by year’s end, a target that now looks unlikely. Meanwhile, competitors are accelerating: Alphabet’s Waymo maintains a strong lead, and Amazon-backed Zoox has rolled out in Las Vegas. The outlook for robotaxis remains uncertain. While the potential market is enormous, turning this into meaningful revenue streams will likely take far longer than Musk initially promised.