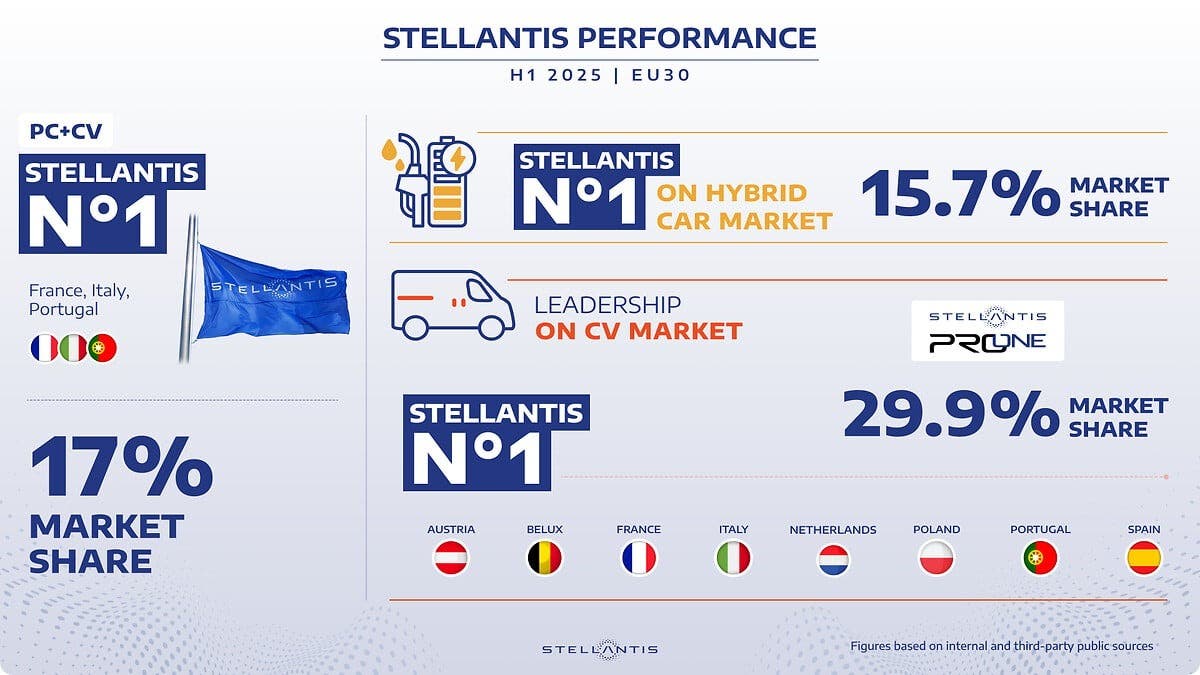

Sales of hybrid vehicles increased again, +4.2pp year-to-date: Stellantis continues to be the leader in the segment.Leadership confirmed even in LCV market, shrinking by 13% year-to-date, while Stellantis gains 1.4pp in H1 2025 compared to H1 2024, reaching nearly 30% market share. Order intake is up 10% year-to-date, while Company inventory has been reduced by 16% over the same period.Stellantis is leader in France, approaching a 30% year-to-date market share, both overall and in the electric segment. Peugeot leads the way in the overall market with a 15.6% share (+1pp vs. 2024) and three models in the top ten: 208 (#2), 2008 (#5), and E-3008 (#7). Stellantis also leads in Italy. FIAT remains the top-selling brand, with the Panda as the market’s best-seller. Jeep® Avenger is the best-selling SUV year-to-date, while Alfa Romeo Junior tops the premium B-SUV rankings. In the Iberian Peninsula, Stellantis maintains its leadership in Portugal and tops the overall electric market in Spain. In Germany and UK, the Opel/Vauxhall Corsa ranks first in the B-Hatch segment year-to-date. In the UK, Stellantis leads the small van segment, with PEUGEOT, Citroën, and Vauxhall in the top three positions.

Stellantis the end of the first half of 2025

Amsterdam, July 30, 2025 – At the end of the first half of 2025, Stellantis recorded a 17% share of the total EU30 car market. The Group reaffirmed its leadership in the light commercial vehicle segment, while continuing its growth in the hybrid vehicle segment — where Stellantis climbed two positions to take the lead during the first half of the year.

Jean-Philippe Imparato, Stellantis Chief Operating Officer for Enlarged Europe, commented “We are delivering commercial results in line with 2024, although our market share has seen a slight decline due to the end of production for some key models. On a positive note, Stellantis is the undisputed leader both in A and B segments and our order intake is steadily growing: our order backlog is already 13% higher than in December 2024.”

“These strategically important results,” concluded Jean-Philippe Imparato, “allow us to navigate market turbulence with greater consistency. Moreover, in the first half of the year, Stellantis launched 15 new models across 10 different brands, including the Citroën C3 Aircross, Opel/Vauxhall Frontera, and FIAT Grande Panda — marking a strong offensive in the B-segment, the results of which will soon be reflected in volume performance. By year-end, the new FIAT 500 MHEV and new Jeep® Compass will arrive.”

[1] In this report, we include or refer to industry and market data, derived from or based upon a variety of official, non-official and internal sources, such as internal surveys and management estimates, market research, publicly available information and industry publications. Market share data may change and cannot always be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data-gathering process, different methods used by different sources to collect, assemble, analyze or compute market data, including different definitions of vehicle segments and descriptions and other limitations and uncertainties inherent in any statistical survey of market shares or size. Although we believe that this information is reliable, we have not independently verified the data from third-party sources. In addition, we typically estimate market share for automobiles and commercial vehicles based on registration data.*: The hybrid segment includes bothPHEV (Plug-in Hybrid Electric Vehicles) and HEV (Hybrid Electric Vehicles).