The recently announced trade agreement between the United States and Japan is being hailed as a major win for Japan’s auto sector, but not everyone is celebrating. For American automakers like Ford, but also another giant like General Motors, the deal raises red flags about competitiveness, tariffs, and long-term production strategies.

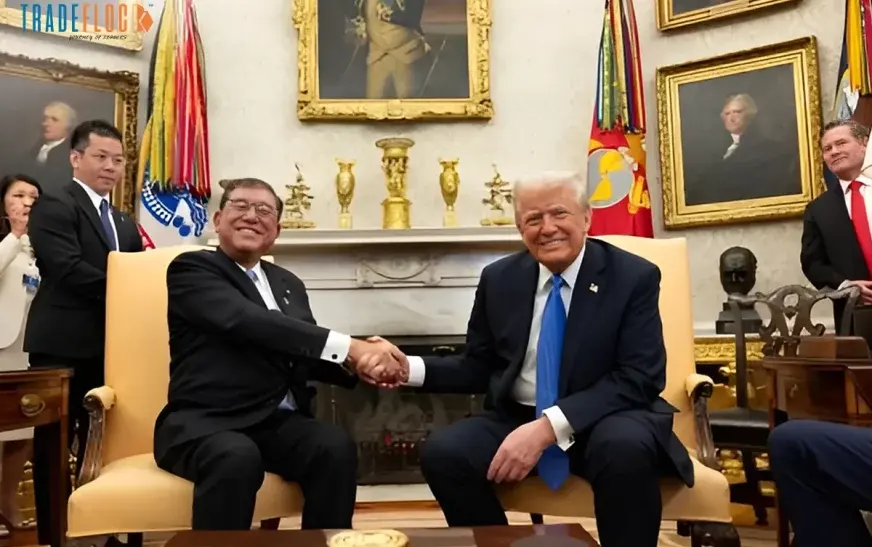

On Tuesday, President Donald Trump unveiled the terms of the new trade pact via Truth Social, highlighting a massive $550 billion investment from Japan into the US economy. He claimed the agreement would lead to the creation of “hundreds of thousands of jobs” and outlined a new mutual tariff rate of 15%. However, sources familiar with the deal indicate that this 15% rate will also apply to vehicles and auto parts, a clause that could tilt the playing field in Japan’s favor.

Unlike Ford, which pay a steep 25% tariff to import cars from Mexico under current trade policies, Japanese manufacturers now benefit from significantly lower costs when shipping vehicles to US shores.

This arrangement simultaneously reduces pressure on Japanese companies to manufacture vehicles stateside and undermines the position of American automakers operating plants in Mexico and Canada. While the tariff is still higher than the 10% imposed on imports from the UK, the deal offers Japan tariff access without any annual quotas. To make matters worse, US-based manufacturers continue to face elevated prices for essential materials like aluminum, copper, and steel, thanks to earlier Trump-era tariffs. These costs place American carmakers at a disadvantage even before production begins.

Though the agreement opens Japanese markets to American vehicles, the reality is underwhelming. In 2024, US automakers sold only about 16,000 vehicles in Japan, a mere 0.35% of the country’s total market. Penetrating the Japanese market would require billions in investment and years of strategic positioning. Meanwhile, Japanese brands like Toyota and Honda continue to dominate US streets.

While some investors hope for similar deals with South Korea and even Europe, the broader consensus is that the Japan pact complicates an already volatile trade landscape. Former Missouri Governor Matt Blunt, now president of the American Automotive Policy Council, cautioned that any agreement favoring low-content foreign imports over North American-built vehicles is a bad deal for US manufacturing and labor.