Ford is reportedly in talks with the Chinese EV giant BYD to supply batteries for its expanding lineup of hybrid vehicles. According to reports citing sources close to the matter, the Blue Oval is looking to import these power cells to its manufacturing plants outside the United States. It’s a bold strategy: asking your biggest global rival to help you build the very cars meant to compete with them.

The negotiations come at a sensitive time for Ford, which recently announced it would take a staggering $19.5 billion charge as it retreats from its all-in electric vehicle strategy. With consumer demand for pure EVs cooling faster than a discarded cup of coffee, Ford has pivoted toward hybrids, plug-in hybrids, and extended-range electrics, aiming for these models to represent half of its global sales volume by 2030.

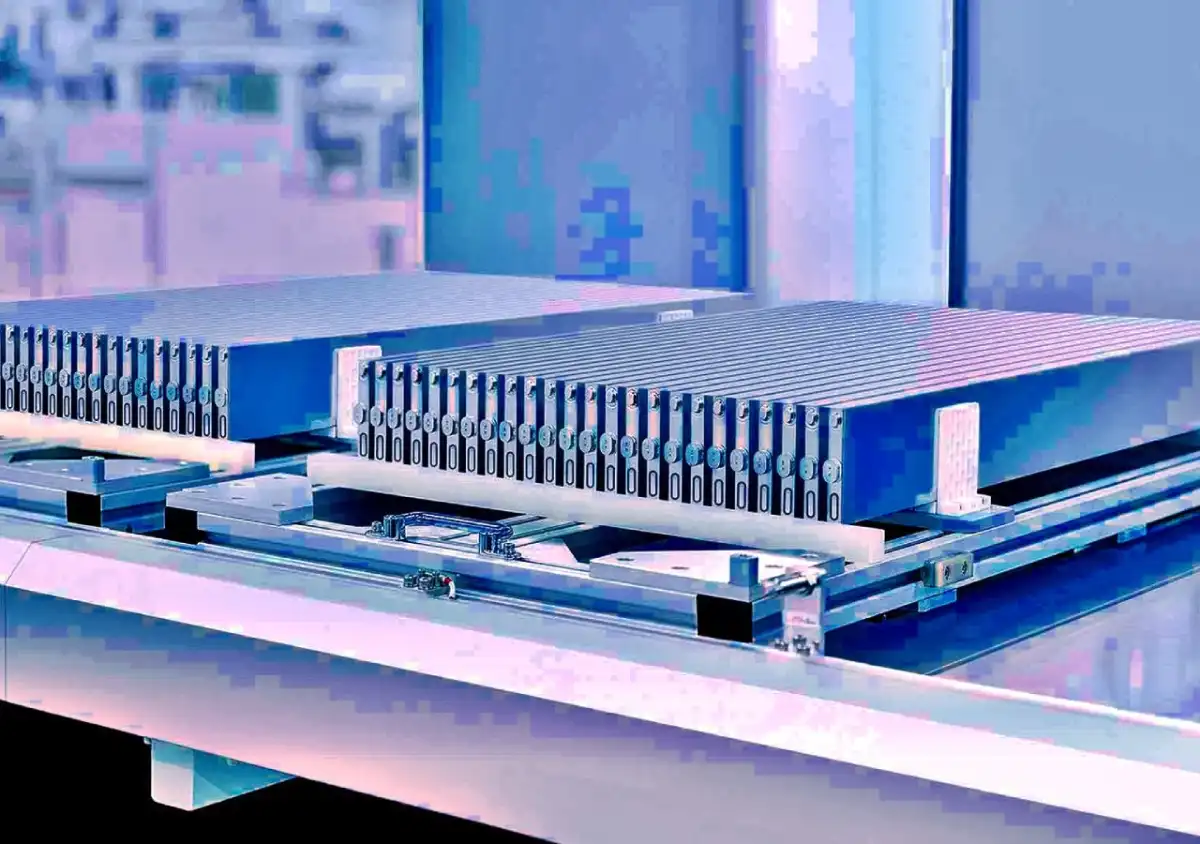

To hit that goal, the company desperately needs a reliable source of high-quality hybrid batteries, and BYD, which was a battery powerhouse long before it started building cars, is the obvious, if politically awkward, choice.

The prospect of an American icon relying on Chinese tech has ruffled feathers in Washington. Peter Navarro, a trade advisor to President Donald Trump, took to social media to blast the plan, questioning why Ford would want to support a competitor’s supply chain while making itself more vulnerable to “supply chain extortion”.

While BYD does have a bus-building presence in California, it currently produces zero passenger car batteries on American soil, focusing its massive production capacity in China and emerging hubs like Brazil and Europe. If the deal goes through, Ford would gain access to advanced, reasonably priced technology that has already “alarmed” the rest of the US auto industry. For now, the two giants remain at the negotiating table. The line between “competitor” and “supplier” is thinner than a smartphone screen.